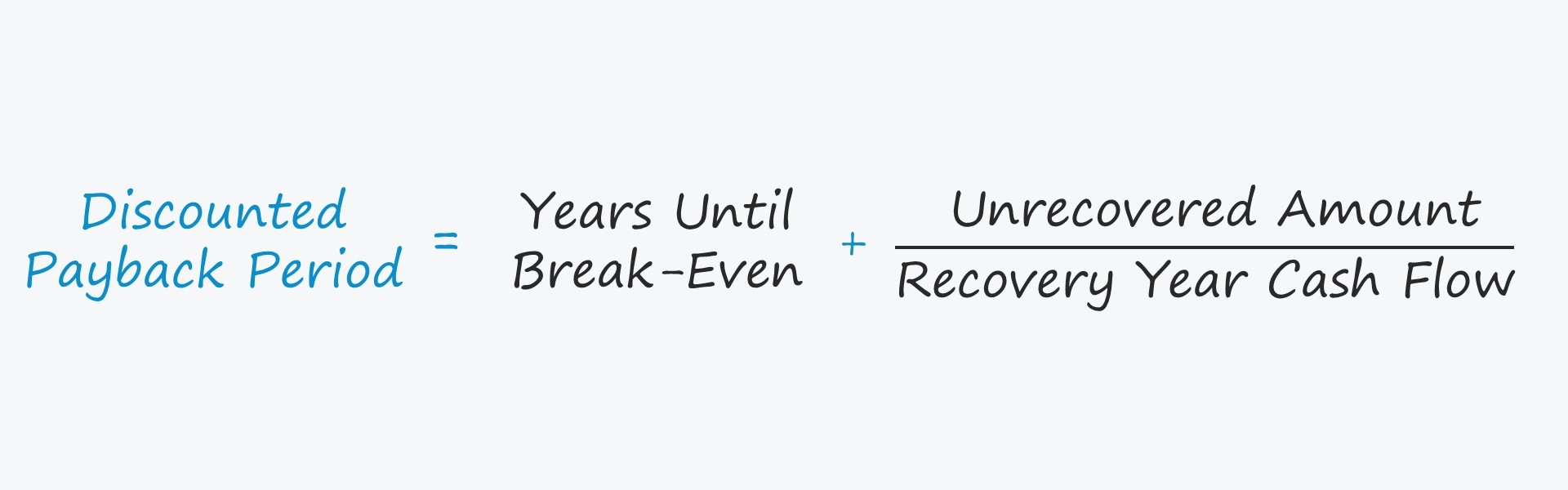

Discounted Payback Period Formula

Lets look at the calculations. Advantages of discounted cash flow.

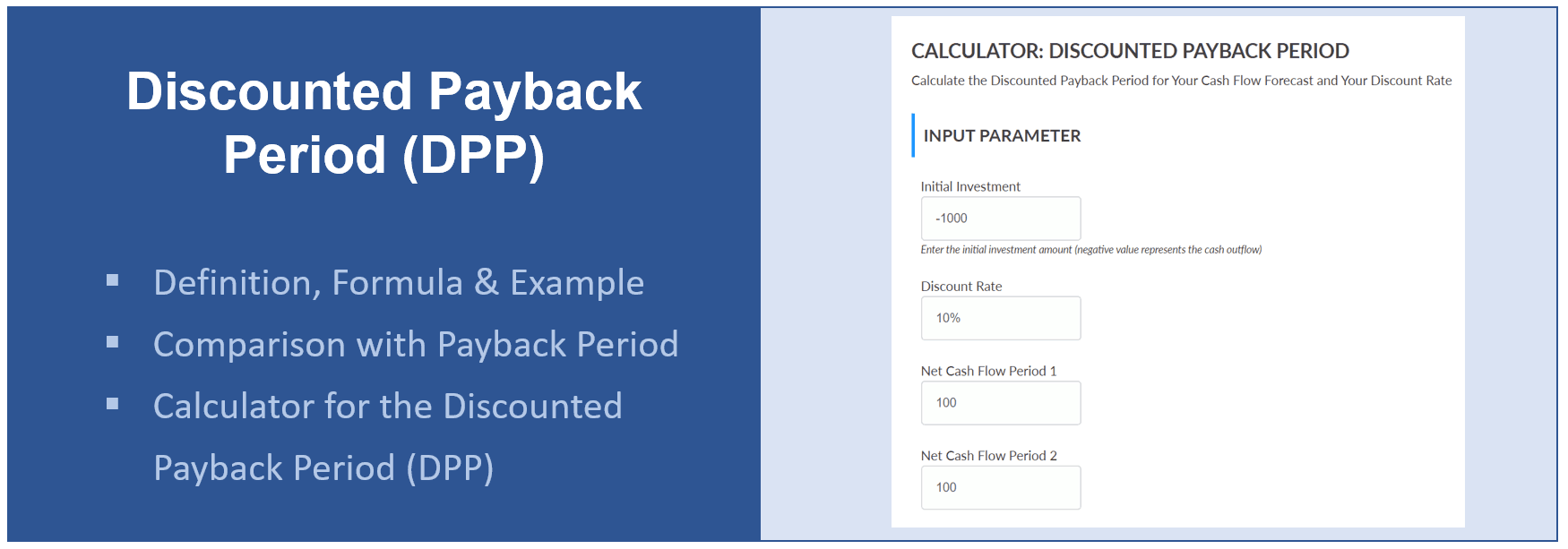

Discounted Payback Period Meaning Formula How To Calculate

The number of years that the project remains unprofitable to the company.

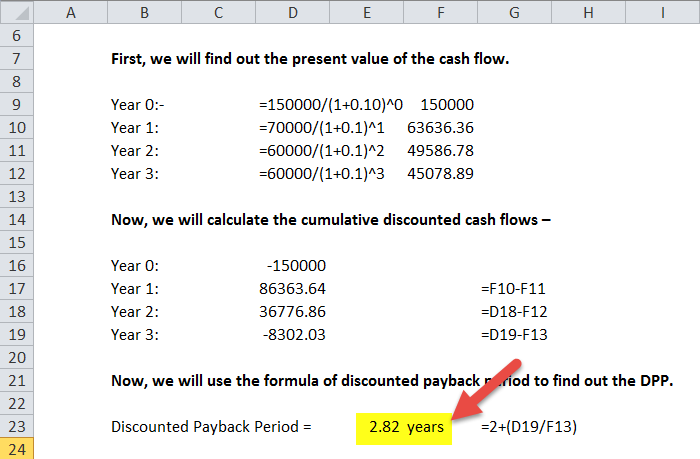

. However the discounted payback period would look at each of those. The discounted cash flows are then added to calculate the cumulative. The discounted payback period formula is the same as that simple payback period method explained in a different post apart from one thing.

The discounted payback period DPP is a success measure of investments and projects. Discounted payback is straight forward there no special. First input the initial investment into a cell eg A3.

Where A Last period with a negative discounted cumulative cash flow. Here is the formula for the. We use two other figures in this calculation the PV or Present Value and the CF or Cash Flow.

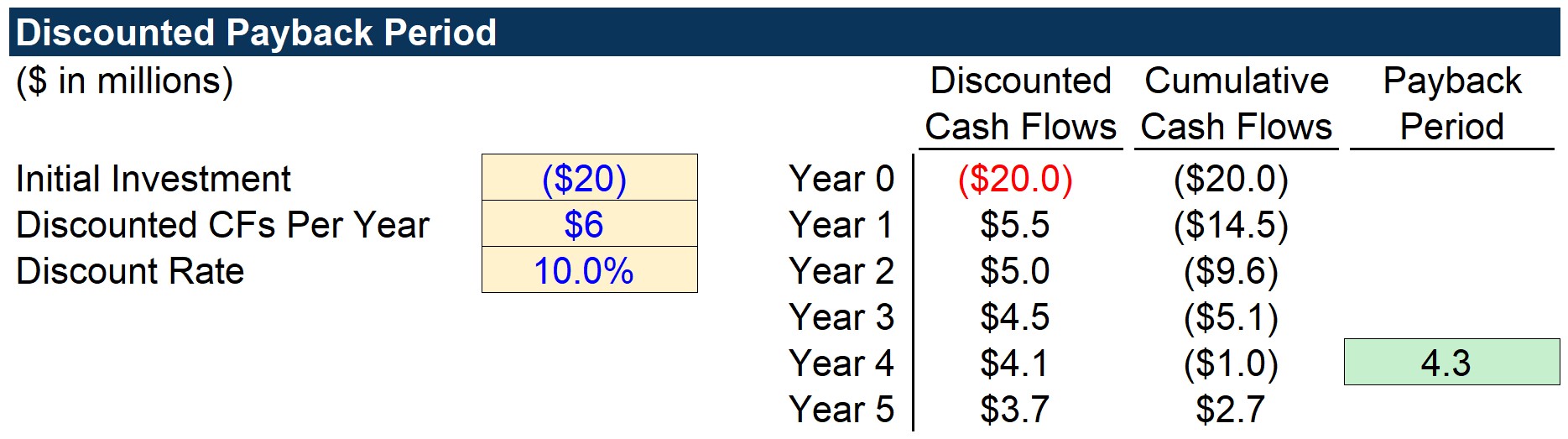

Then enter the annual cash flow into another eg A4. Calculate the number of years before the break-even point ie. The simple payback period formula would be 5 years the initial investment divided by the cash flow each period.

This payback period calculator solves the amount of time it takes to receive money back from an investment. It involves the cash flows when they occurred and the rate of return in the. This video shows an example of how to calculate the discounted payback period for an investmentThe discounted payback method is a decision rule that says a.

Discounted Payback period 5 year 3470039480 587 years. The discounted payback period involves using discounted cash inflows rather than regular cash inflows. To calculate the payback period enter the following formula in an.

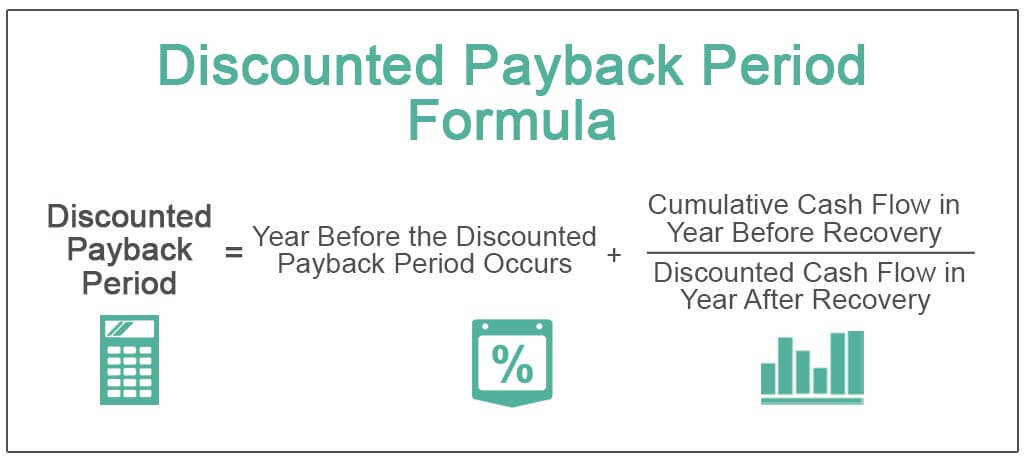

B Absolute value of discounted cumulative cash flow at the end of the period A. To calculate the discounted payback period the future estimated cash flows of a project are taken and discounted to the present value using the discounted payback period formula. Discounted Payback Period Formula.

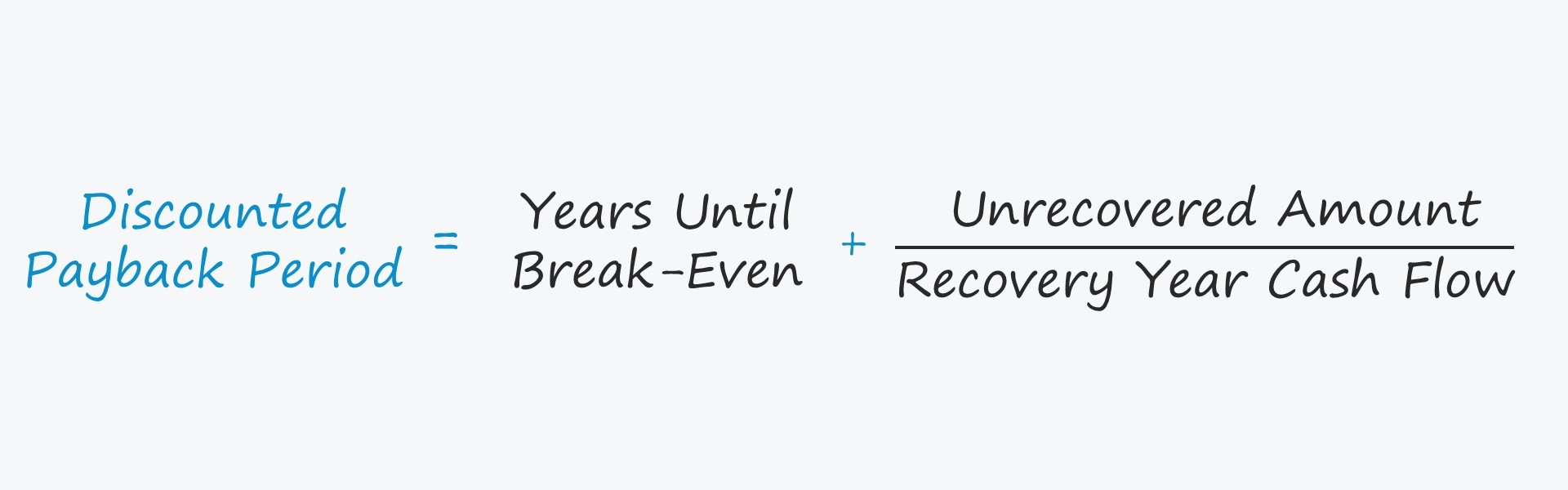

Although it is not explicitly mentioned in the Project Management Body of Knowledge PMBOK. Discounted Payback Period Year before the discounted payback period occurs Cumulative cash flow in year before recovery. The discounted payback period is a capital budgeting procedure which is frequently used to calculate the profitability of a project.

The Discounted Payback Period DPP Formula and a Sample Calculation. The discounted payback period can be calculated by first discounting the cash flows with the cost of capital of 7. In order to calculate the discounted payback period you first need to calculate the discounted cash flow for each period of the investment.

The payback period is the amount of time it takes to recoup the investment. The net present value aspect of a discounted payback.

Payback Period Formula And Calculator Excel Template

Discounted Payback Period Meaning Formula How To Calculate

Discounted Payback Period Formula And Calculator Excel Template

Discounted Payback Period Definition Formula Example Calculator Project Management Info

No comments for "Discounted Payback Period Formula"

Post a Comment